When Pedro Miranda, 47, walks into a high-end store in jeans and a t-shirt, he says that he’s almost always treated badly by store staff.

“In the beginning, they [treat you] like you’re going to rob the store,” he tells CNBC Make It. But things change drastically once he gets to the register and whips out his American Express Centurion Card — aka the Amex Black Card — to pay for his purchase.

It’s as if he’s a totally different person, he says and the salespeople start treating him much better. Once he was even offered the chance to borrow a piece of jewelry for his wife to try out for two weeks and return it. Another time, the salesperson offered to be his personal shopper.

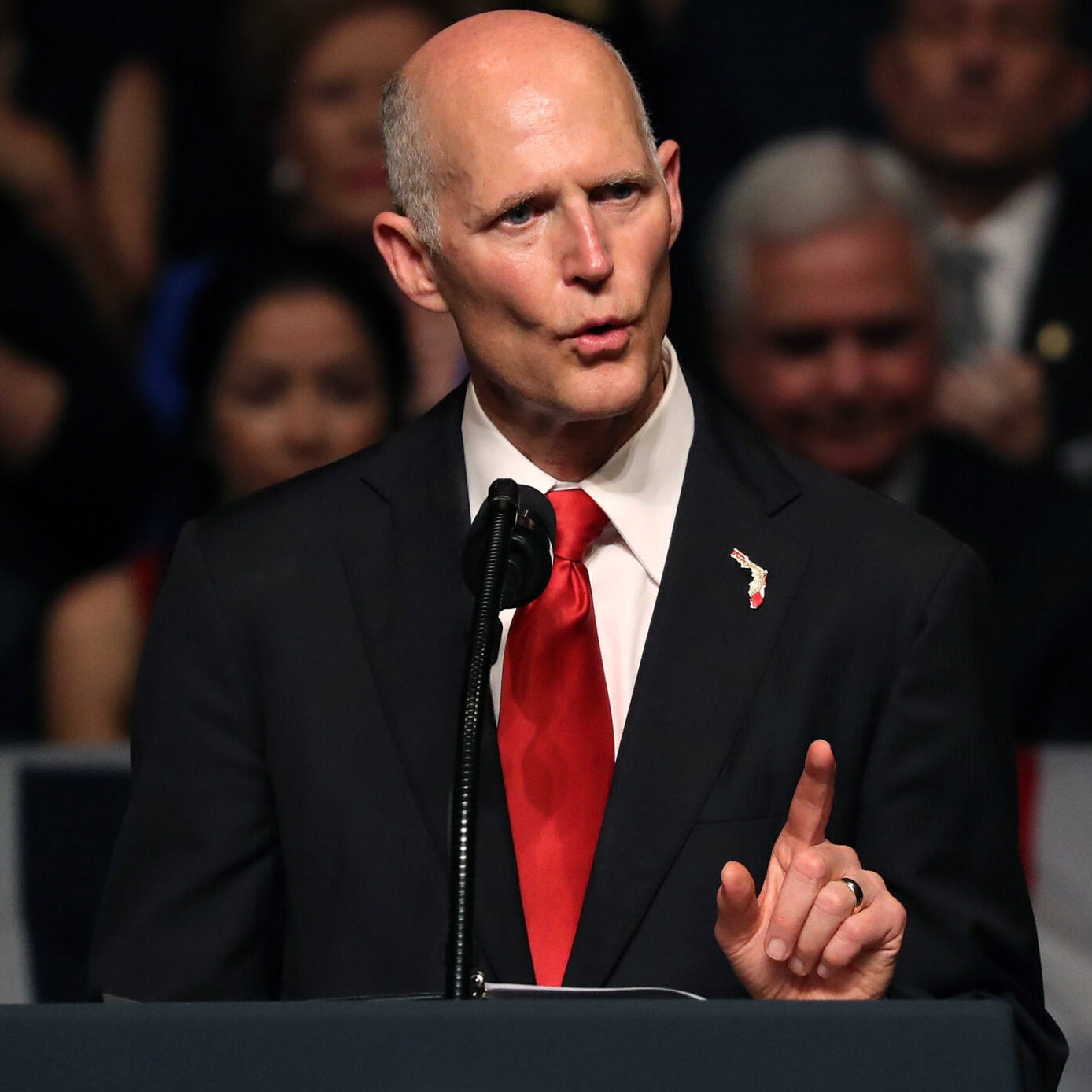

Miranda, an immigrant who moved from Brazil to the U.S. at 18 with no credit history, has been using his Amex Black Card for about 10 years now.

And while he’s quick to say the hefty $5,000 annual membership fee is worth every penny, he wants to reinforce that the status symbol card isn’t something everyone should strive for, especially the younger generation that always seems to want the next shiny object.

“Just because I have a black card doesn’t mean I’m anyone special,” he says.

Below, Miranda talks about how he got invited to be an Amex Black Cardholder, why he likes it and his black card advice for young adults.

Miranda’s credit journey

Although Miranda had zero credit history when he first immigrated to the U.S., he was able to get his first credit card (an American Express card) when he started as an undergraduate student at the University of Miami.

He went on to earn an MBA from MIT and worked as an investment banker at Credit Suisse First Boston and Goldman Sachs, and he continued to use credit cards from American Express, upgrading from the Amex Gold Card to the Amex Platinum.

Miranda recognizes that he made credit mistakes along the way, such as carrying a balance on his card and accruing high interest when he was in college, but he got better as he grew older. He would charge a high volume of transactions on his Amex credit cards, but he was able to pay them off each month so he didn’t have to worry about interest.

This active credit card usage showed that he knew how to use credit responsibly, but it was also the type of spending he was doing that helped him eventually get invited to get an Amex Black Card. Miranda traveled weekly for work, and he had a pattern of spending on airlines and hotels that showed he could benefit from the black card’s exclusive travel benefits.

Why the Amex Black Card is worth it for Miranda

Of course, the Amex Black Card comes with many luxury perks, including hotel elite status, airport lounge access, Equinox gym membership, credits to high-end stores and a 24/7 concierge service. But Miranda says he gets the most value from the card’s overall convenience.

“You don’t sweat anything,” he says of the many times he needed assistance when his card information got stolen (which he says happens almost yearly). “When I have issues with Amex, it’s very smooth to sort that out.”

He recalled one time when he was having dinner in France and someone tried to make a $6,000 purchase with his card in Dubai. “It happens quite often,” Miranda says. “First thing they do is issue a new card and open an investigation.”

Even if the card didn’t come with a ton of extra perks, he would still use it for its customer service alone.

“In my opinion, nobody does customer service like American Express,” Miranda says.

He points out that it’s the little things about the card that he appreciates: Someone picks up right away when you call and you don’t have to listen to hold music, they take care of any card disputes you have, they make sure everything is organized when you make a reservation and they have airport arrival services when flying internationally so that you have a personal guide who takes you quickly through immigration and customs.

Today, Miranda runs a Miami-based private equity fund that invests in real estate so he says these travel benefits save him time.

“They always make sure you’re taken care of so you feel like you’re getting more than you paid for,” Miranda says.

Miranda’s black card advice to the younger generation

“There are a lot of misconceptions about having a black card,” Miranda says. “People see this card and think it’s some magical thing.”

Miranda wants people to know that being invited to have a black card doesn’t mean you’re more special than anyone else, or that you have more money. While he values his card for its convenience when he travels, he doesn’t want others to be attached to thinking that they need to have it in order to reach a certain status in life.

“It’s not about that,” Miranda says. “You need to have stuff that has a purpose to you — I pay $5,000 for this card because it has a purpose to me and prevents aggravation. But there are so many people who want to flash this card. I don’t think there’s much to gain from flashing or boasting about anything.”